A guide to short-term rental tax law in Canada in 2022

Before you read, please note that:

StayPro is a full service property management platform that updates video reports for each turnover, and shares them with Airbnb hosts via an integrated user system. Regular video evidence of your property will ensure that you can document the changing condition of your property without ever needing to be on scene.

Not to mention that StayPro’s services ensure a safe and contactless check-in process for guests and housekeepers. For hosts, no management work is required, so you can get income effortlessly.

Our professional short-term rental experts train the housekeepers to perform quality cleaning & pay attention to details. On top of that, StayPro also sets-up a full protocol to guarantee smooth turnovers and more revenue.

You can skip shopping for a massive amount of spare beddings, shampoos, smart-home devices and towels & save more by simply renting every utility from StayPro! StayPro clients can manage item rental options and restocking amenities on their personal user system.

Need our service? Sign-up here to start a StayPro management package.

Or, subscribe to StayPro’s property management service to learn everything you need to know about short-term rentals.

“In this world, nothing is certain except death and taxes.” Benjamin Franklin said.

There are a number of rules and guidelines that Canadians must follow if they want to engage in short-term renting. Most importantly, short-term rental hosts must declare their income to the Canadian Revenue Agency (CRA).

To determine what tax you need to declare, you have to determine the following information in three steps:

- What is your type of income?

- What are your expenses?

- Do you have to remit GST/HST/QST?

Even if you don’t have to declare the following taxes yourself, StayPro suggests you familiarize yourself with:

-

For Québecois:

- How does the lodging tax work?

- How is lodging tax calculated?

-

For Toronto residents:

- How does the MAT work?

- How is MAT calculated?

What is your type of income?

If you have any questions about what type of income your listing generates, you may want to check out the Canada Revenue Agency site or speak with a tax professional.

Here are two types of income StayPro’s clients usually declare:

- Rental income: You must file form T776 (Statement of Real Estate Rentals) and declare the income on line 126 of your federal return.

-

Business income: You must file the following:

- Line 135 on form T776, as part of self-employment income.

- The Canada Pension Plan (CPP) premiums on net income.

What are your expenses?

There exist two types of expenses which StayPro’s clients usually declare:

- Current expenses, that is, ongoing-period expenses that don’t have a lasting benefit, such as heating and cooling.

- Capital costs, that is, expenses that have a longer lasting benefit, such as technology or equipment.

Do I have to remit GST/HST/QST?

According to Airbnb Support Canada, Airbnb hosts “who are not registered for Goods and Services Tax (GST), Harmonized Sales Tax (HST), and/or Québec Sales Tax (QST) will not have any obligation to collect and remit the GST, HST, and/or QST on their accommodation. National law will require Airbnb to collect and remit these taxes.

Hosts with Airbnb listings who are GST-, HST-, and/or QST-registered should continue to account for the GST, HST and/or QST on their accommodation. National law does not impose the tax-collection obligation on Airbnb for GST-, HST-, and/or QST-registered Hosts.”

Do I need to register for a GST/HST account?

According to the Canada Revenue Agency, a host must register for a GST/HST account is both situations apply:

- “You make taxable sales, leases, or other supplies in Canada (unless your only taxable supplies are of real property sold other than in the course of a business)

- You are not a small supplier,” that is you do not exceed the $30,000 threshold for four consecutive calendar quarters

You cannot register for a GST/HST account if you deal with exempt supplies only.

Since we do not update the article in real time, please make sure that the information is still applicable. StayPro advises that you do your own research as this article is not comprehensive, and does not constitute legal or tax advice.

Lodging tax in the province of Québec

How does the lodging tax work?

The Lodging Tax is a Québec-specific tax which is 3.5% of the listing price for reservations of 31 nights or fewer. For more information, visit the Québec Revenue website.

Here's a quick explanation for you: Airbnb guests who booked listings in the province of Québec will have to pay the Lodging Tax as a part of their reservation. Airbnb collects and remits it, so you don’t have to do anything!

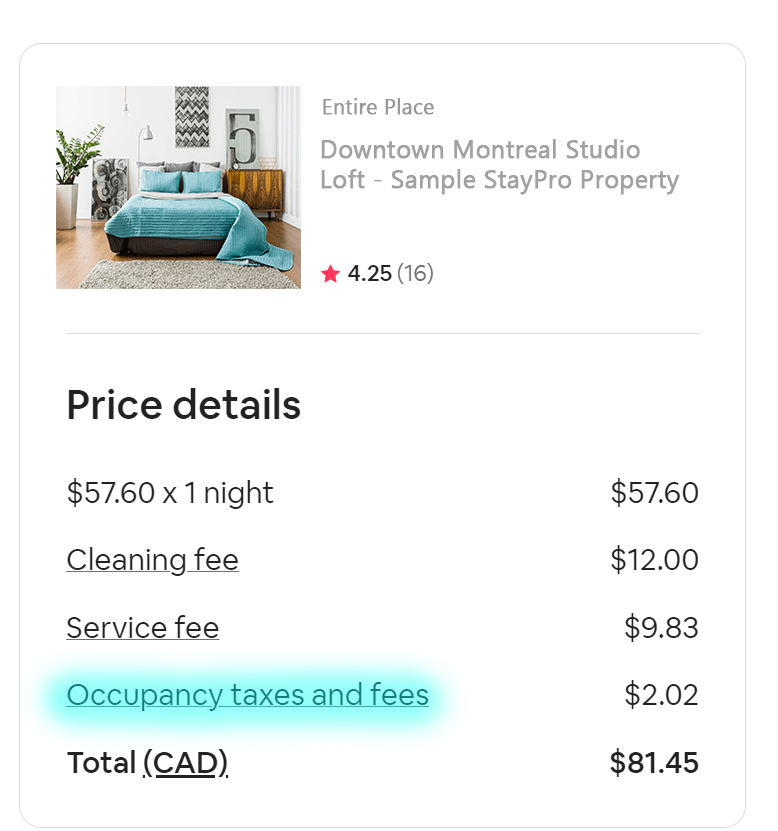

How is lodging tax calculated?

Here is a breakdown of your guest’s payment if they would like to book your property. The “Occupancy taxes and fees” equals the total cost of the Lodging Tax. It is calculated by multiplying the nightly rate by the 3.5% Lodging Tax percentage. In this case:

Occupancy taxes and fees = $57.60 (Nightly rate) ✕ 3.5% (Lodging Tax) = $ 2.02

Please note that the cleaning fee is not taxable. Therefore, to avoid your guest paying unnecessary taxes, StayPro would always charge a cleaning fee separately without adding it to the nightly rate.

Municipal Accommodation Tax for Toronto residents

The MAT is 4% of the listing price for all reservations. For more information, visit the City of Toronto website.

How does the MAT work?

Here's a quick explanation for you: Airbnb guests who booked listings in the city of Toronto, Ontario are required to pay the Municipal Accommodation Tax (MAT) as a part of their reservation. Airbnb collects and remits it, so you don’t have to do anything!

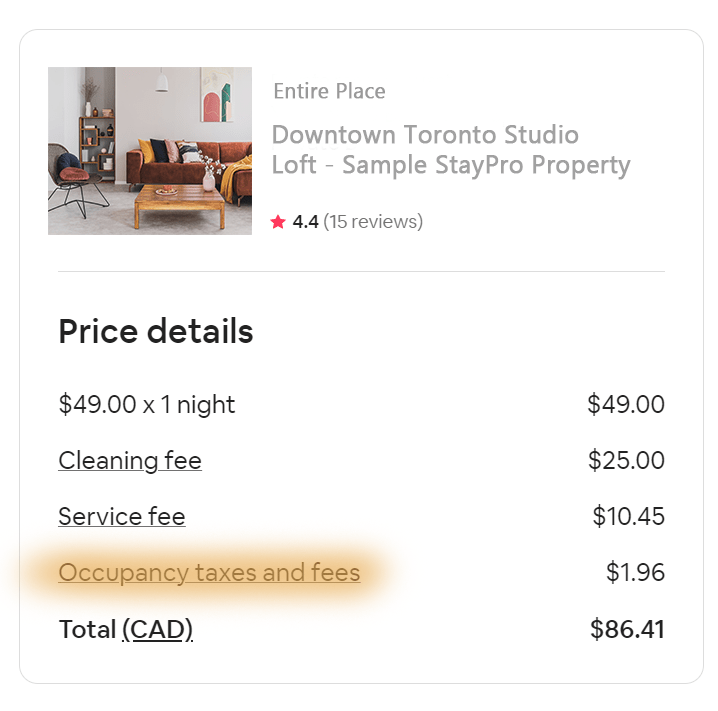

How is MAT calculated?

Here is a breakdown of your guest’s payment if they would like to book your property. The “Occupancy taxes and fees” equals the total cost of the MAT. It is calculated by multiplying the nightly rate by the 4% MAT percentage. In this case:

Occupancy taxes and fees = $49 (Nightly rate) ✕ 4% (MAT) = $1.96

Please note that the cleaning fee is not taxable. Therefore, to avoid your guest paying unnecessary taxes, StayPro would always charge a cleaning fee separately without adding it to the nightly rate.